How to earn interest from lending on the Bitcoin Swap from BitMEX?

This step by step guide will show you how you can earn interest by shorting Bitcoin. Shorting Bitcoin on BitMEX essentially means you are holding a USD position. It is a great way to hedge your portfolio against Bitcoin price movements whilst earning sizable interest payments.

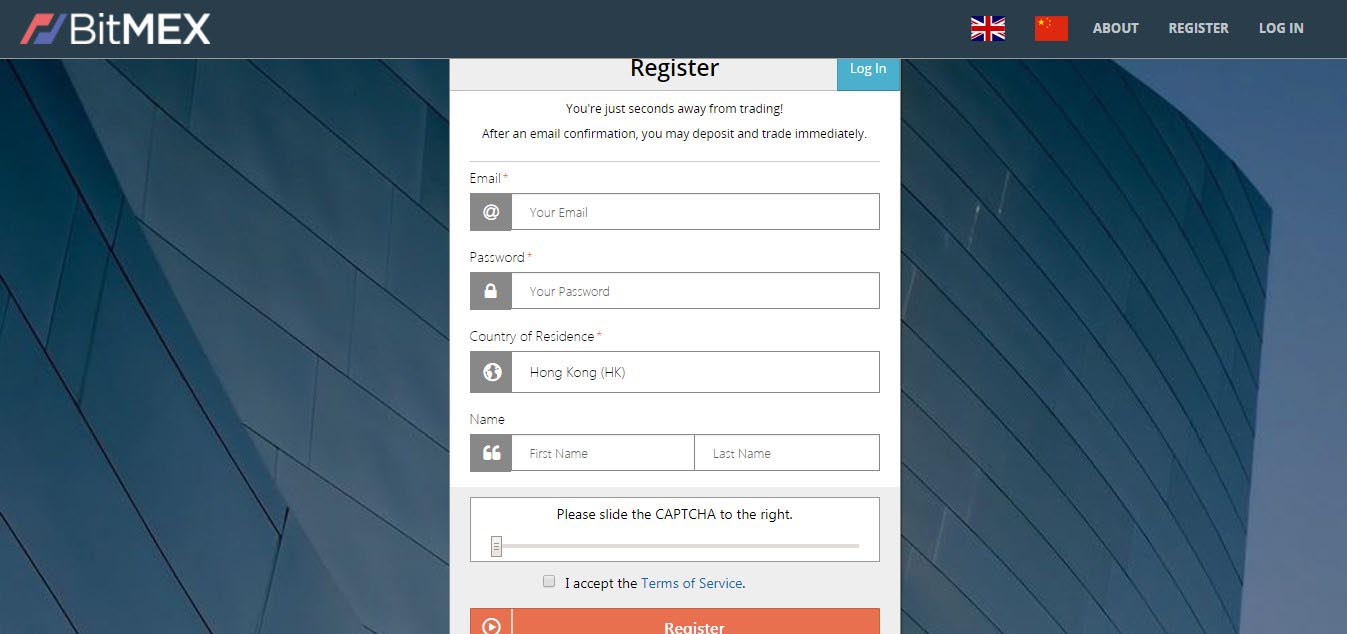

Step 1: Register on BitMEX

Register on BitMEX using this link to get 10% off trading fees for 6 months. No code required, just use the link below to sign up.

https://www.bitmex.com/register/JOyORf

Step 2: Click on 'REGISTER'

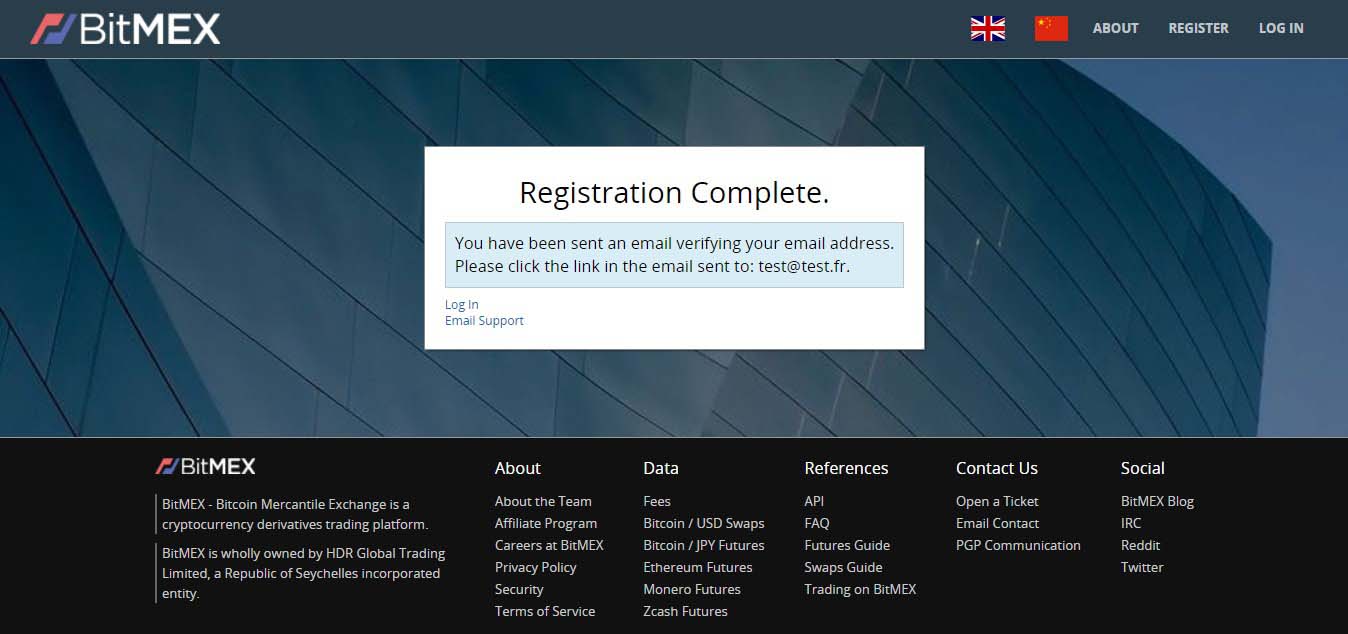

Step 3: Verify your Email

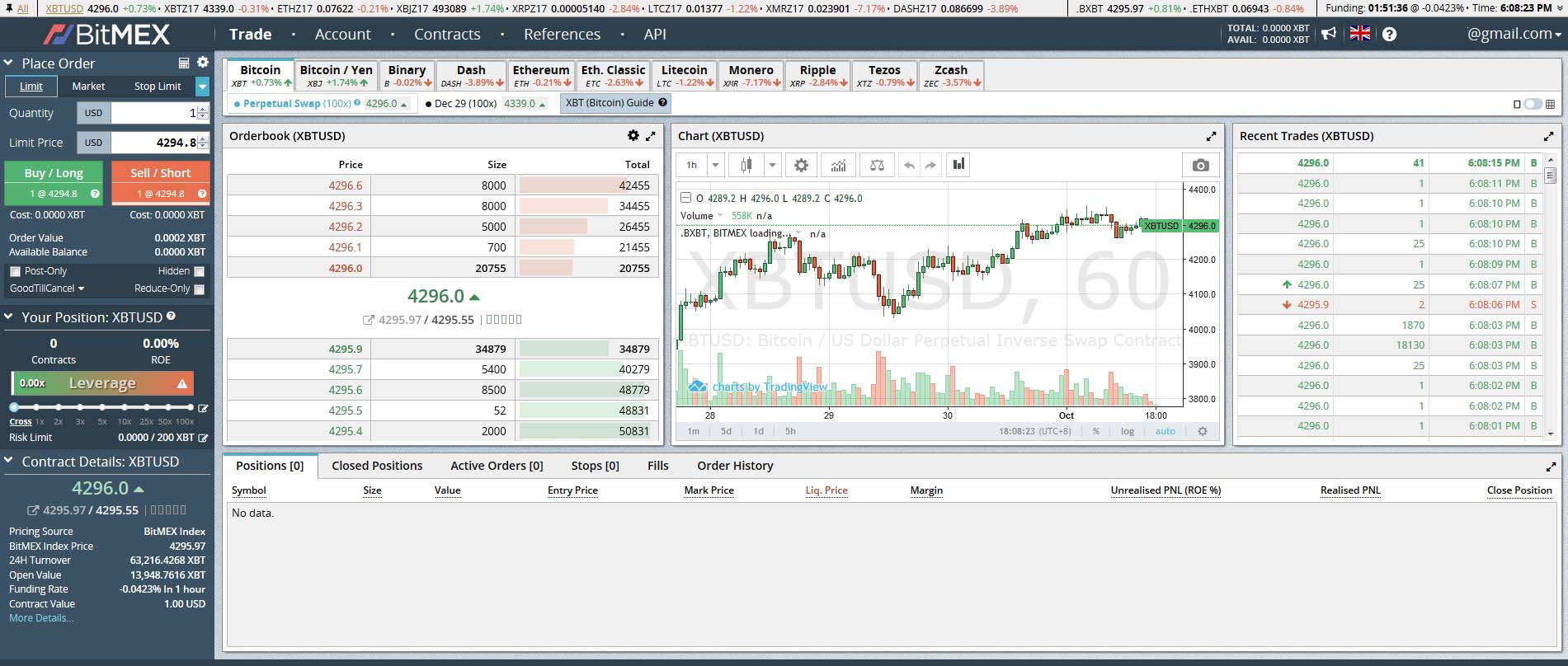

Step 4: Welcome to the BitMEX trading page

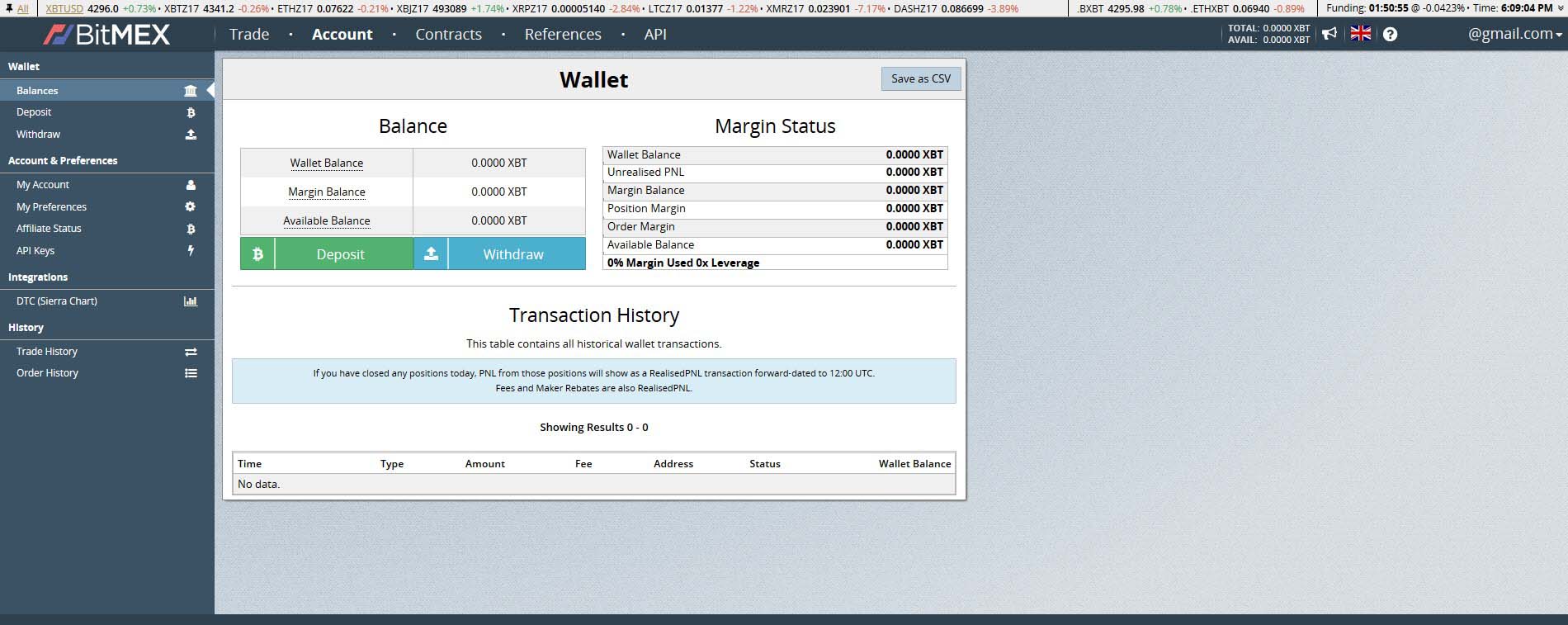

Step 5: Go to your ACCOUNT page.

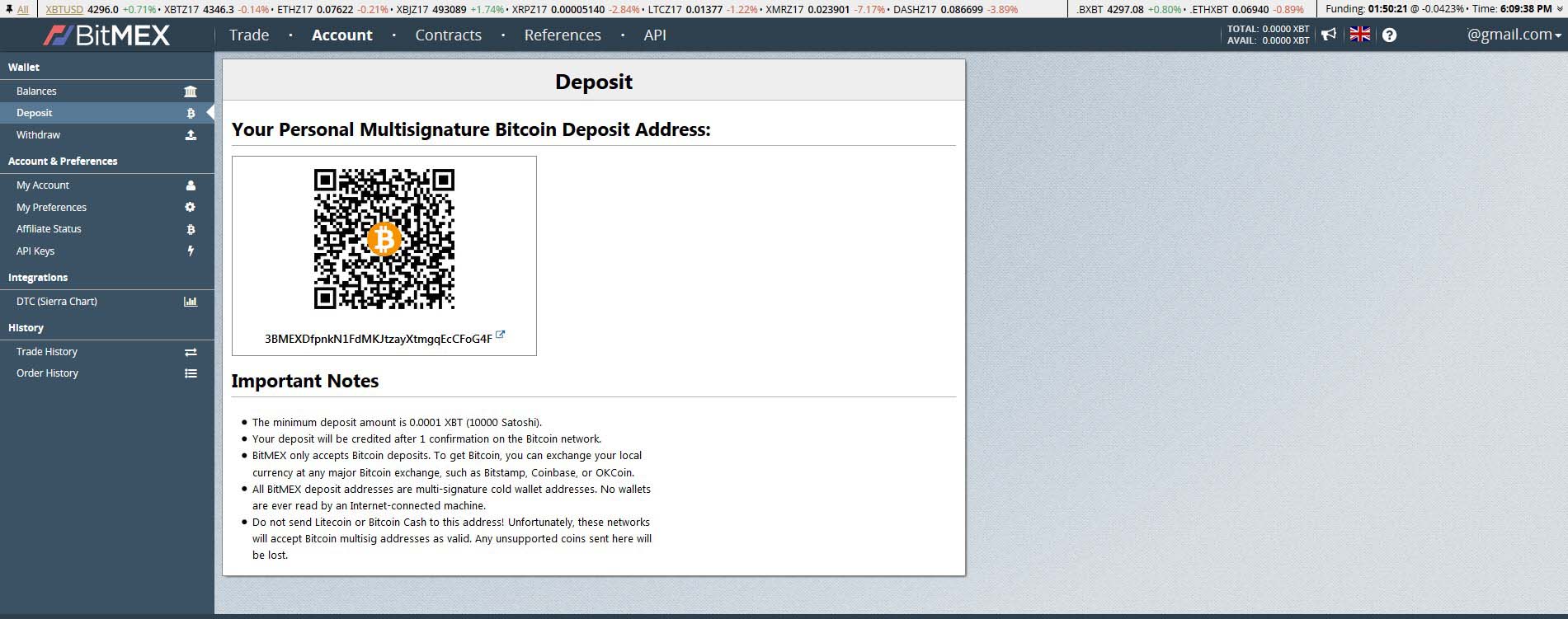

Step 6: Deposit some Bitcoin. BitMEX only accepts Bitcoin. No other currencies.

Step 7: Wait for deposit to be received.

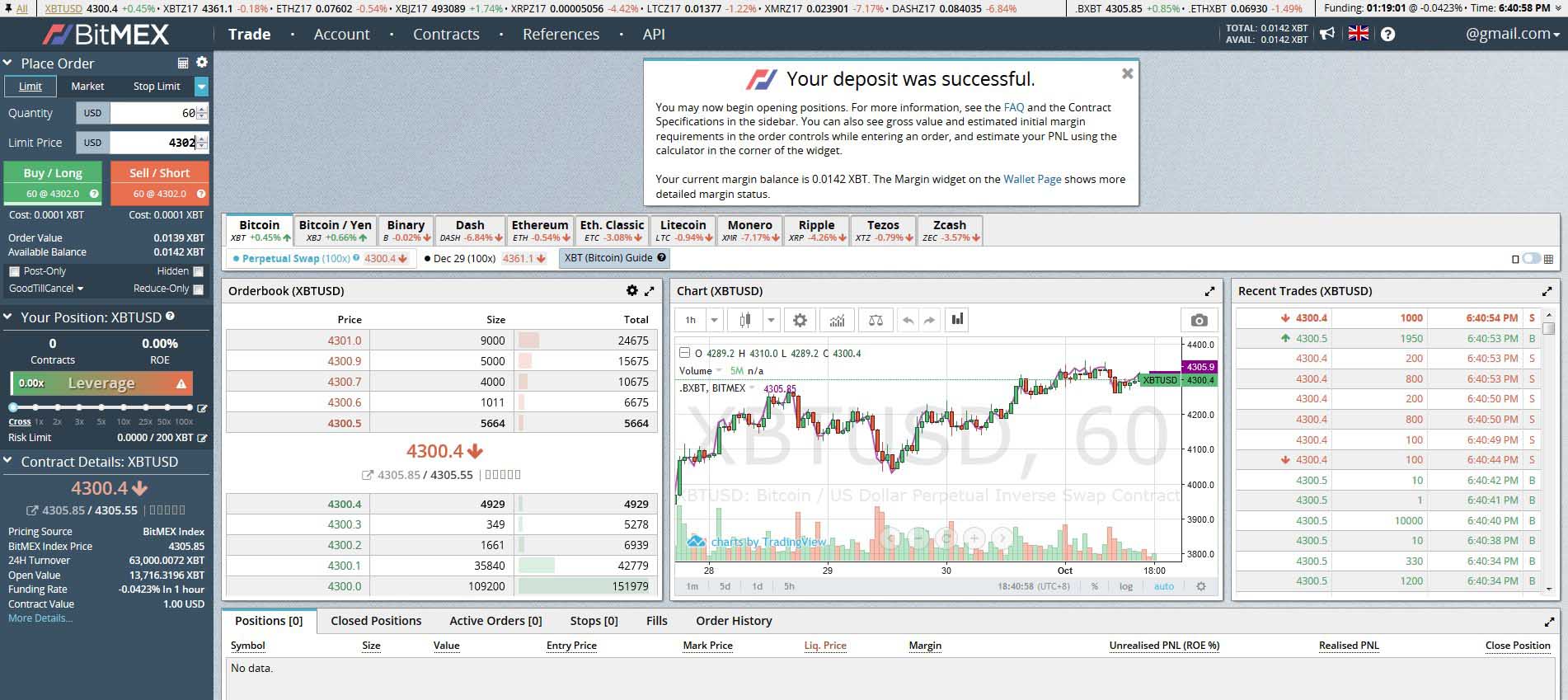

Step 8: Enter how much USD you want to short and at which Bitcoin price Make sure that if shorting, your limit price is higher than the current trading price. Select your leverage, start off at 1x.

Alternatively you can use a market order to short Bitcoin. The difference is that with a market order, it will execute at the current market price in the order book.

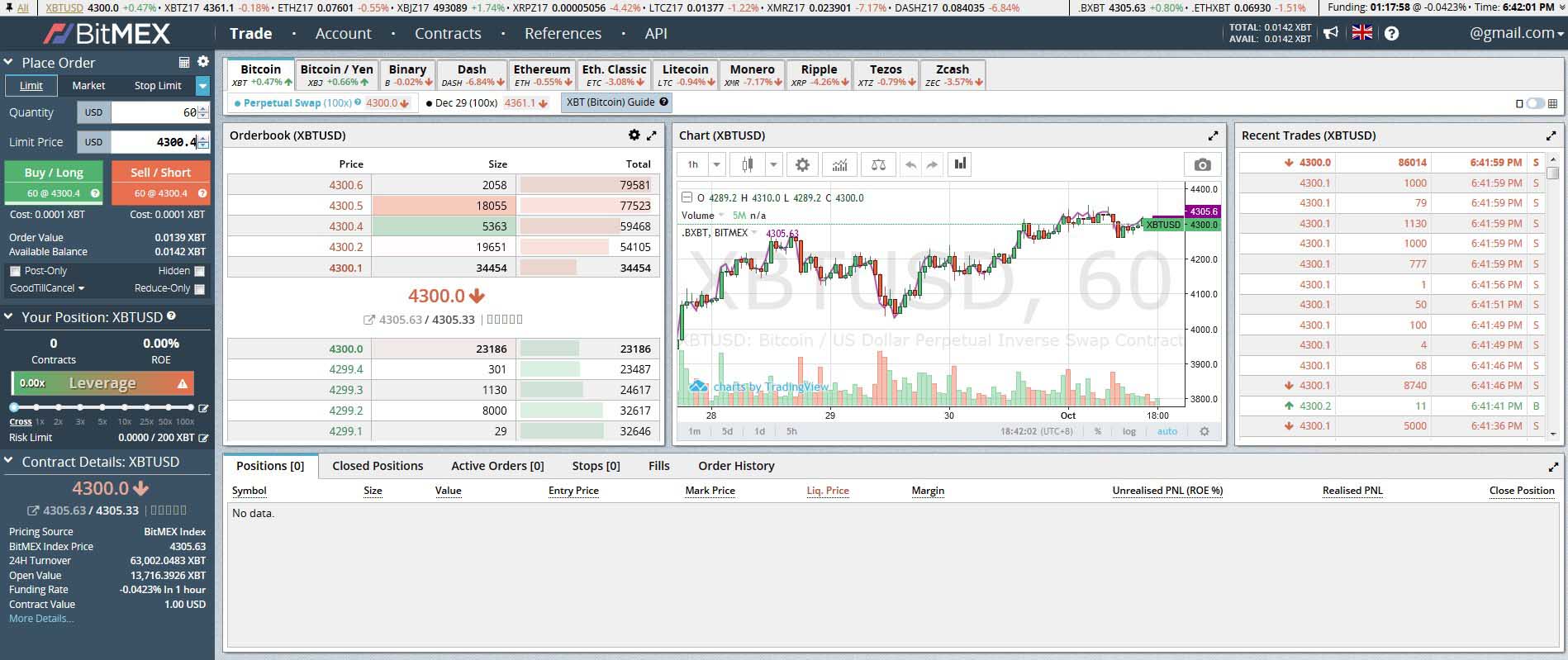

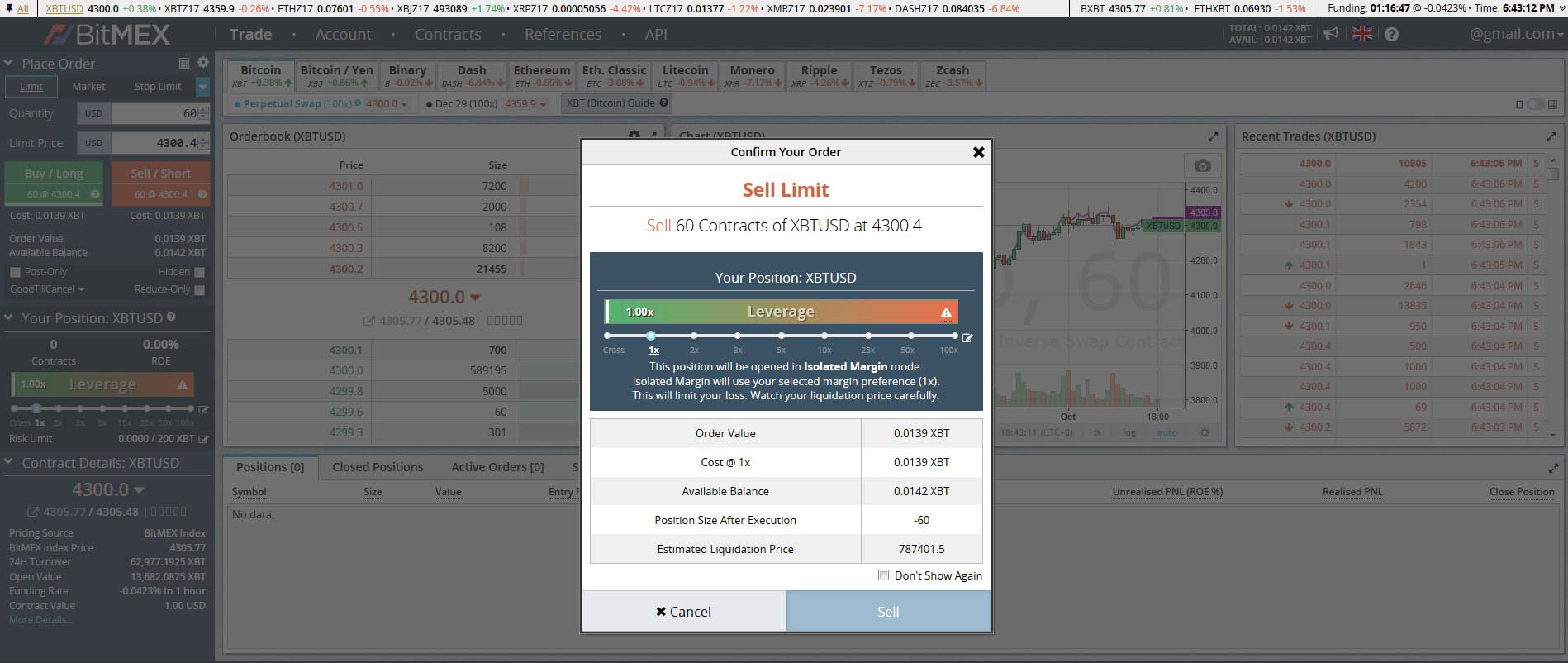

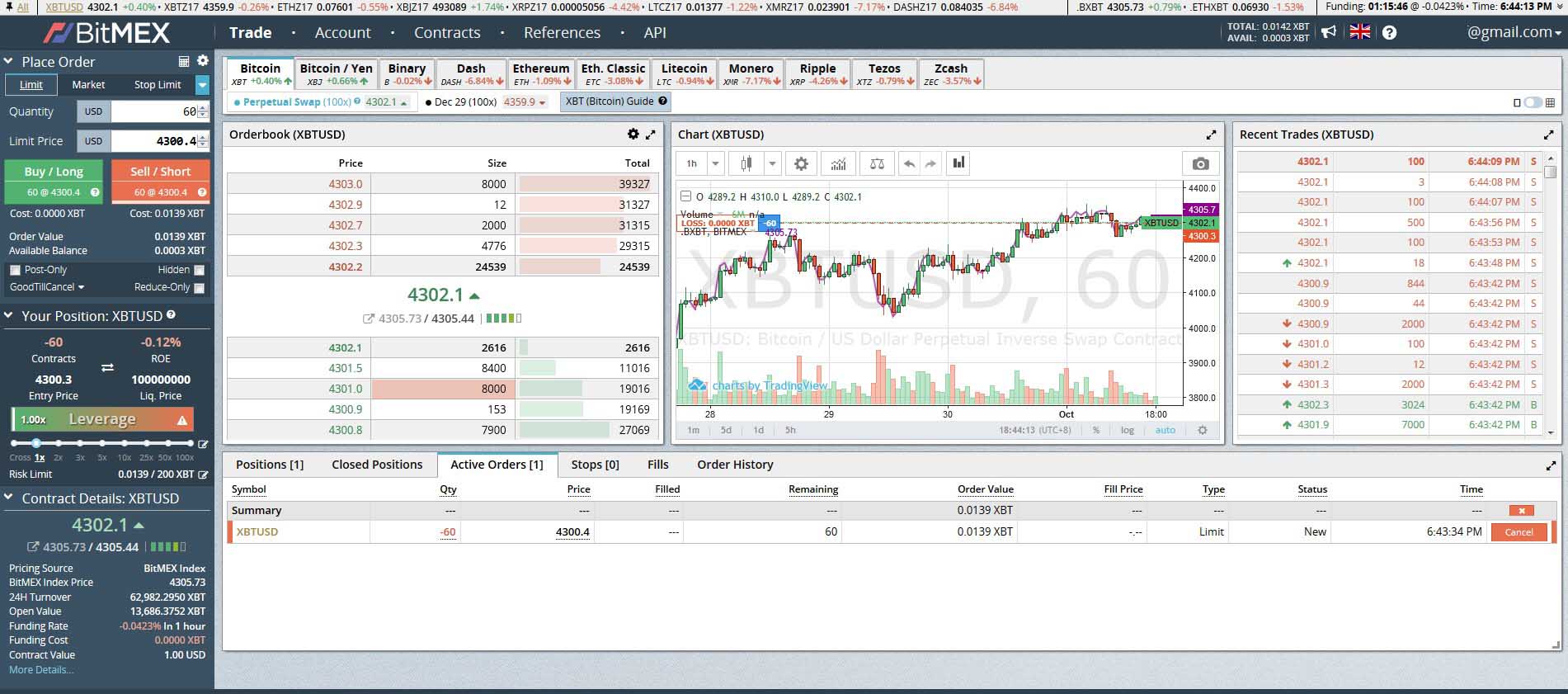

Step 9: Here we see that I am shorting 60USD at a price of 4300.4USD using 1x leverage.

The short has been placed, as it waiting to be filled.

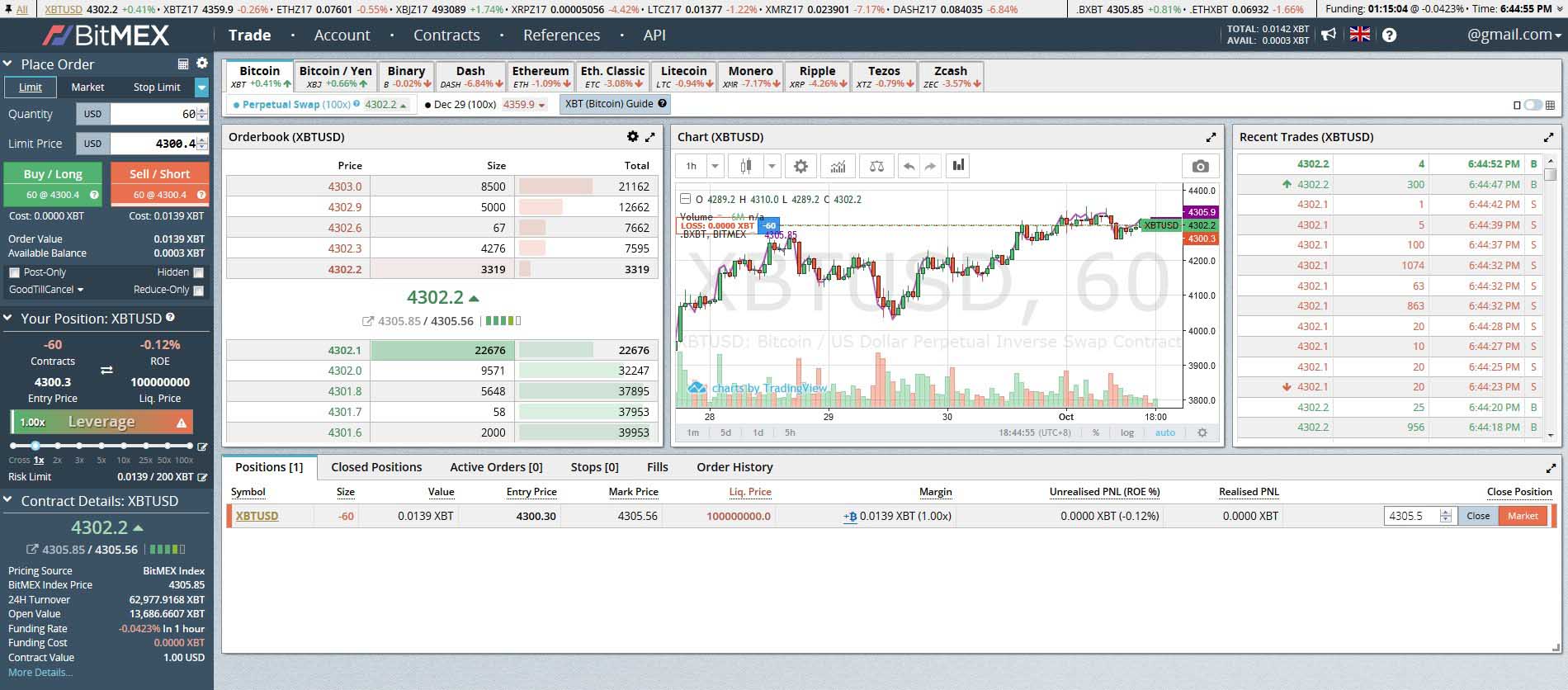

Step 10: Bitcoin short executed. The limit order was executed at 4300.3. You are now shorting Bitcoin, or in other words you are holding 60USD.

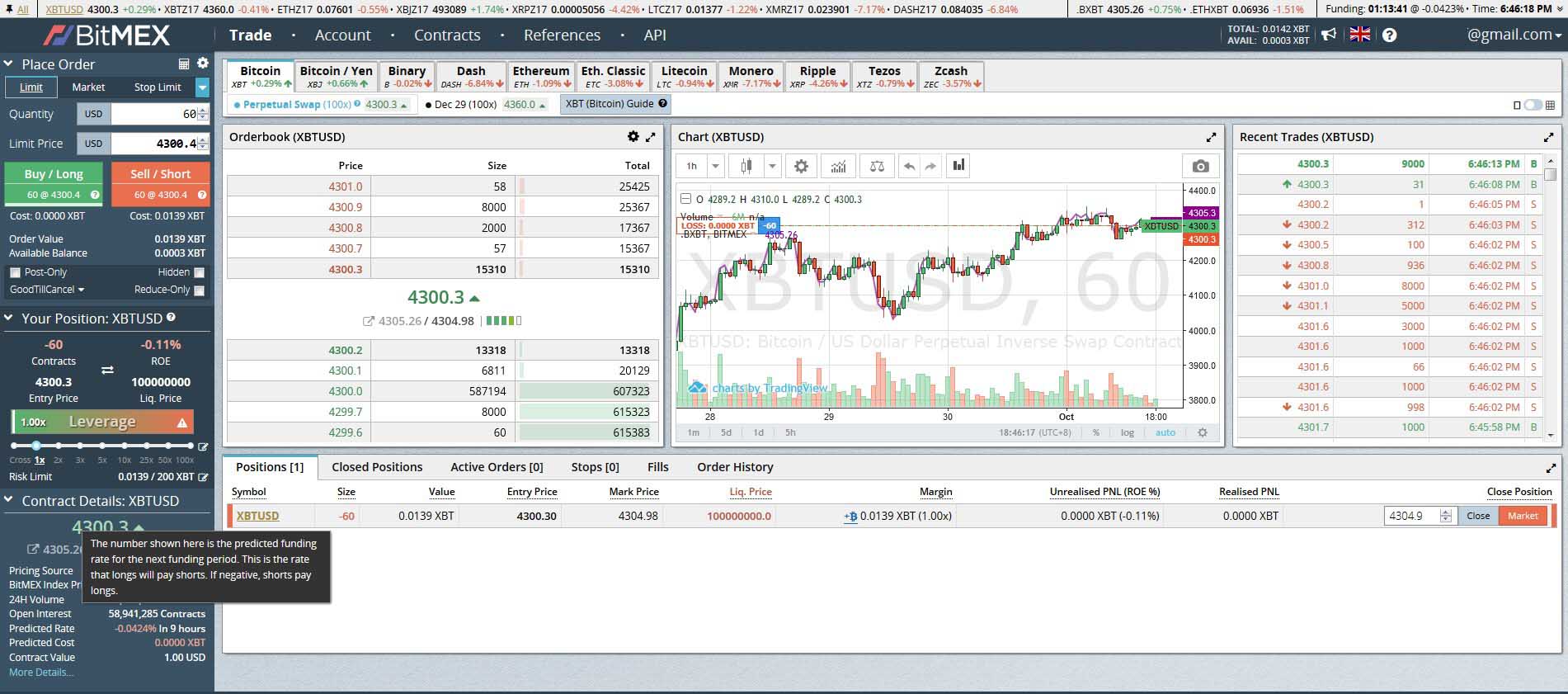

Hover over the funding rate to see more information. You will see it says, "This is the rate longs will pay shorts." this is true only when the rate is positive.

As you can see below the rate is negative (-0.0423%) this means that my short will need to pay longs.

Despite the negative rate in this funding period (above), it is usually positive. You can see historical funding rates here: https://www.bitmex.com/app/fundingHistory

Interest is paid every 8 hour period, so 3 times a day. At 4am UTC then at midday UTC and then at 8PM UTC.

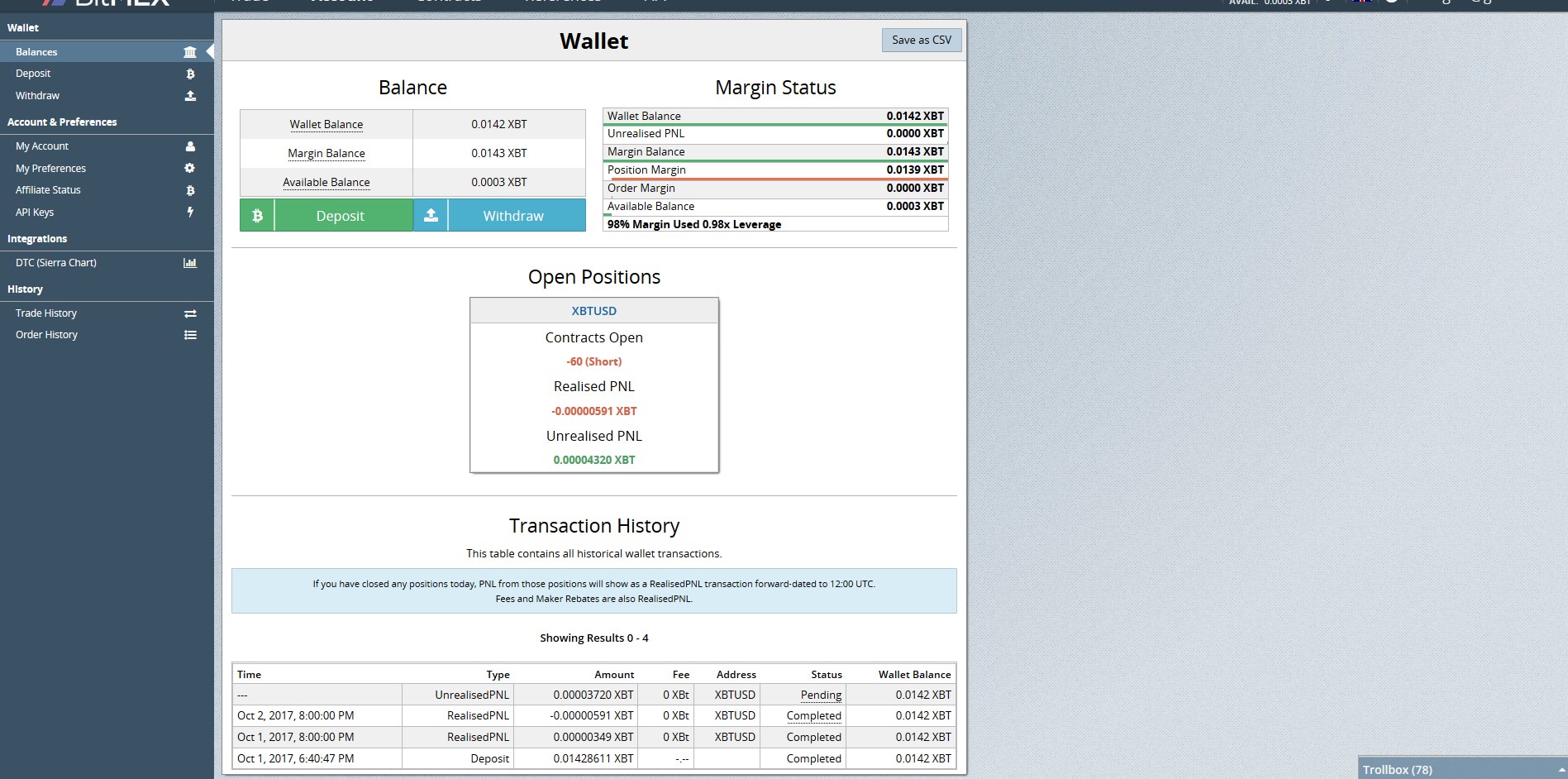

When you are shorting Bitcoin your position (Unrealised PNL) will change according to price of Bitcoin, until you close your short, at which point you will turn it into a Realised PNL. But your interest payments will be realised (Realised PNL) every 8 hours and come into your account.

From the example we can see that I have lost -0.00000591 BTC, as the rate was negative and therefore I had to pay longs. This is not a concern to me, as the rate is usually positive, and I will most likely make it back in the next funding periods.

Once you have mastered shorting with 1x leverage, you can try shorting with 2x leverage. But only if you understand the potential risks of total loss. Shorting on 2x allows you to keep some of your Bitcoin in cold storage, so you are not at so much exposed to counterparty risk. If you do this you will need to make sure that you never reach your liquidation price.

If you found this step by step guide useful, please use my referral link below to get a discount for 6 months on BitMEX.