How to lend your crypto and USD using an automated bot to earn interest on Bitfinex, Poloniex, Liquid, Celsius, Nexo and other exchanges?

Lending your coins and funds on crypto exchanges is a good way of earning extra income. You can do this on most exchanges that offer margin trading, such as Bitfinex, Binance, Poloniex and Liquid. Also on Celsius, Nexo and Upcoin. Although be careful on some of these lesser well known platforms.

How much can you make?

Well, lets look at USD rates on Bitfinex, at present the yearly interest rate is 8.63%. Which can be quite enticing, being higher than many bank rates. Historically it hasn’t been too uncommon to see rates range from around 4% per year, and even up to 30% at times. If you are lucky you can catch a spike at rates above 100%. Crypto rates tend to be very low, during bull markets. However, during bear markets the rates usually increase as people want to short. For example the yearly rate right now for Bitcoin on Bitfinex is 0.03%. This is extremely low, but that’s because not many people are shorting. So, if you lend 5 bitcoins for 30 days, you would earn 0.00012 bitcoins. That’s 0.5 USD at current prices. Not at all worth it. Compare this to the current USD lending rates, if you lent 20,000 USD (about 5 bitcoins worth), you would earn 142 USD over 30 days. Considerably better!

Is it safe?

One of the reasons the rates are normally quite good, is because lenders are pricing in the counterparty risk of the exchange being hacked or losing the funds. For example, Bitfinex was hacked in August 2016. I have been fortunate enough to have never lost funds. You should of course make sure you accounts are secure, using two factor authentication, IP whitelisting, and any other security features available. Similarly Poloniex socialised its losses from a crash in the price of CLAM lent on margin against BTC and did a haircut on all BTC on its platform.

Is it easy?

Yes, and no. If you were to manually lend out all your coins 100% of the time, then you would have a full time job on your hands. Most of us have day jobs and other things to do. This is why I use Coinlend, an automated lending bot with integrations into Bitfinex, Poloniex, Liquid, BitMEX (Beta) and Celsius. And hopefully Binance soon. Coinlend helps me save an enormous amount of time, and helps me earn passively whilst I get on with my day.

Lets take a look at Coinlend

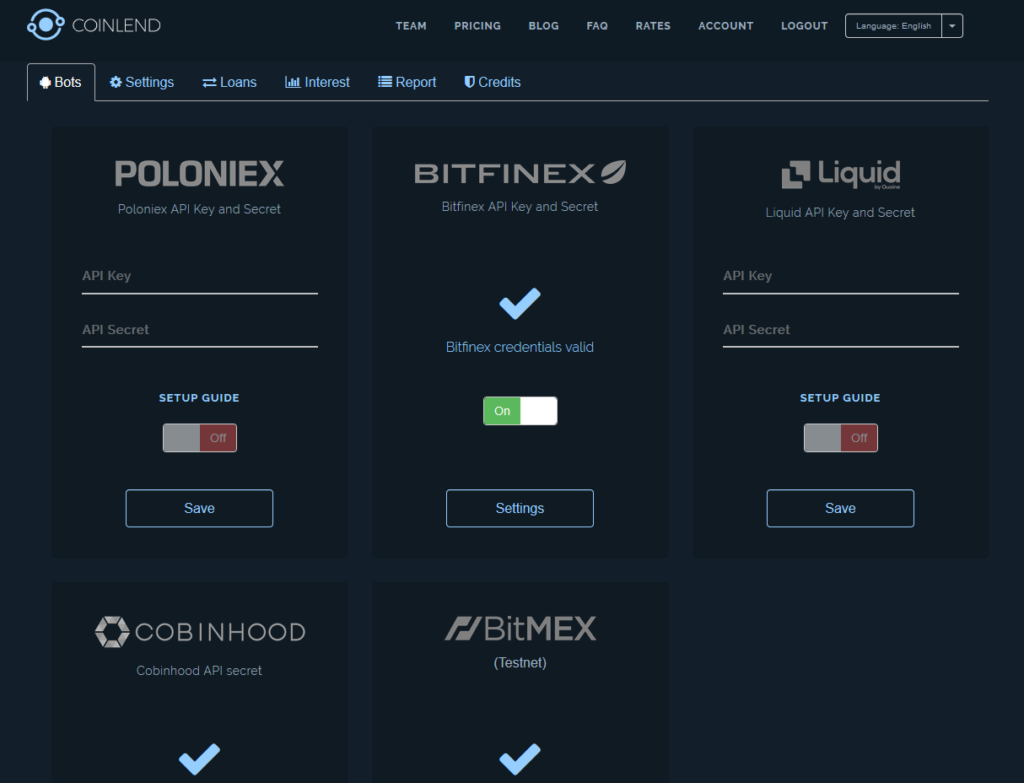

Once you have logged in, you get to the Bots page, this is where you can add the API keys from the exchanges and change the bot settings.

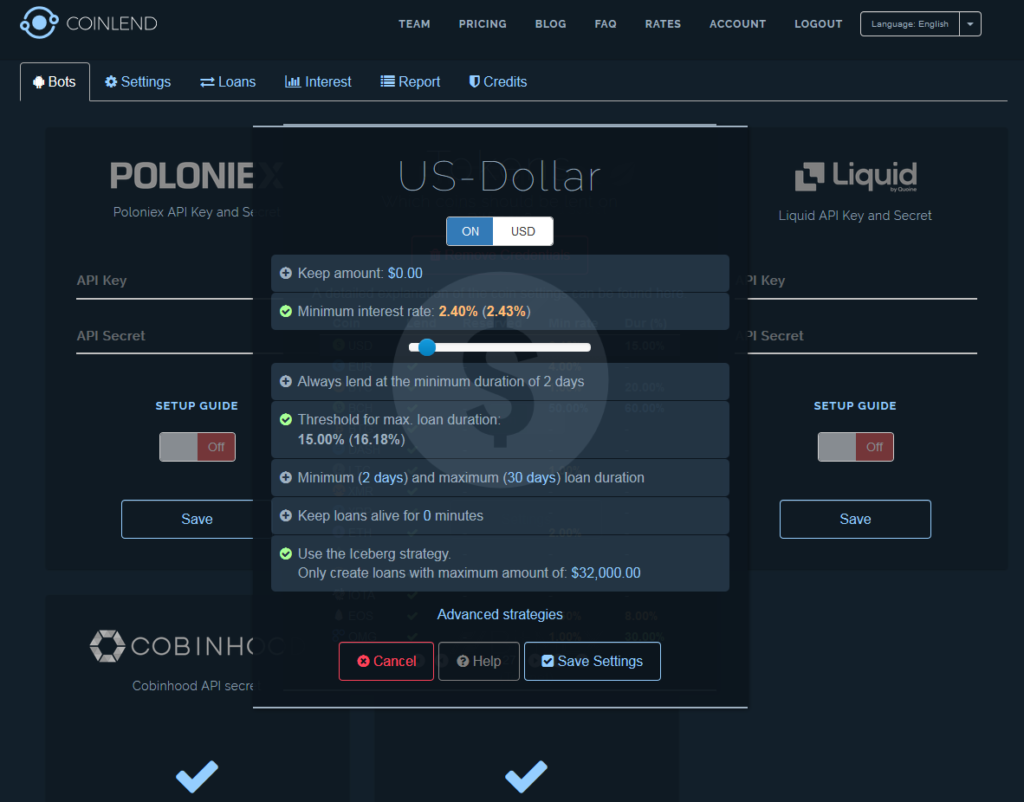

You can easily change the settings for any coin or currency.

Keep amount: Choose an amount you don’t want to be lent out.

Minimum interest rate: The bot won’t lend your funds below this rate.

Threshold for max loan duration: If the rate goes above this, then lend at the maximum amount of days, 30 days for Bitfinex.

Keep loans alive for 0 minutes: The bot can leave you loan offers a bit longer, rather than removing them every time it refreshes to make new loans.

Use Iceberg strategy: To prevent big loan walls in the order books of the exchanges, you can create a smaller loan.

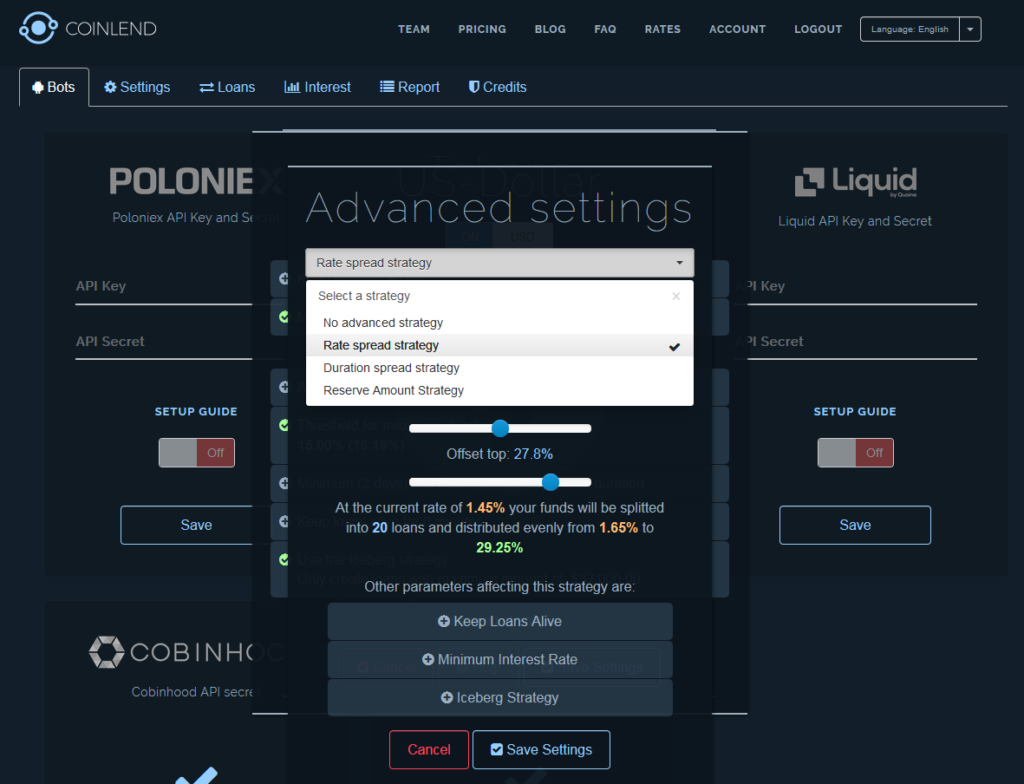

Advanced Settings

These features help you earn more interest by allowing for more complex lending strategies.

Rate Spread Strategy: Spread your loans at different interest rates, allowing you to catch rate spikes as they happen. This is my personal favourite.

Duration Spread Strategy: Spread your loans across different durations.

Reserve Amount Strategy: Help you reserve funds wor when there is a spike in interest rates. Allowing you to lend more at a higher rate.

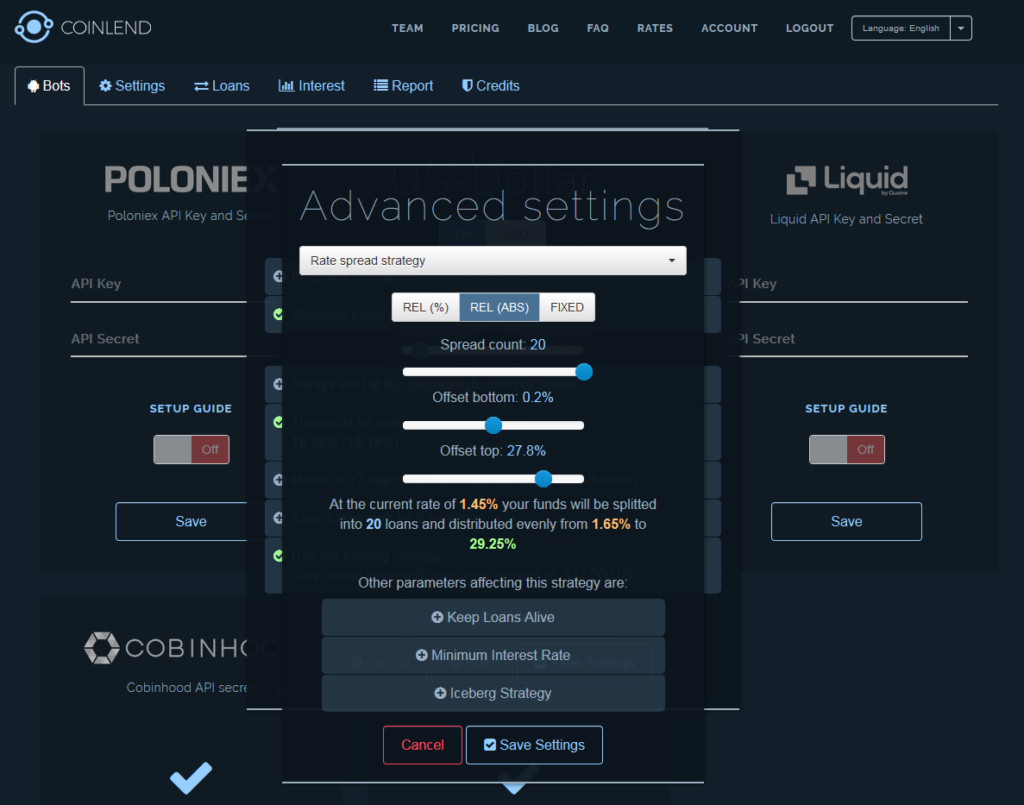

The rate spread strategy in this example, shows that my loans will be split 20 times, starting from 0.2% above the current rate of 1.45% and up to 27.8% higher, which means from 1.65% to 29.25%.

This allows me to get higher rates than standard users, and also catch spikes as and when they happen.

It’s also possible to use standard strategies with advanced strategies, such as Keep Loans Alive, Minimum Interest Rate and Iceberg Strategy.

The Loans tab gives you an overview of all the loans you have lent and waiting to be lent. Utilization rate is quite important. Ideally you want all your funds to be lent all of the time, so closer to 100% the better. But sometimes when the rates are below what you are willing to lend, it might be better to not lend.

The interest tab gives you a nice overview of the interest you have earned and expected to earn.

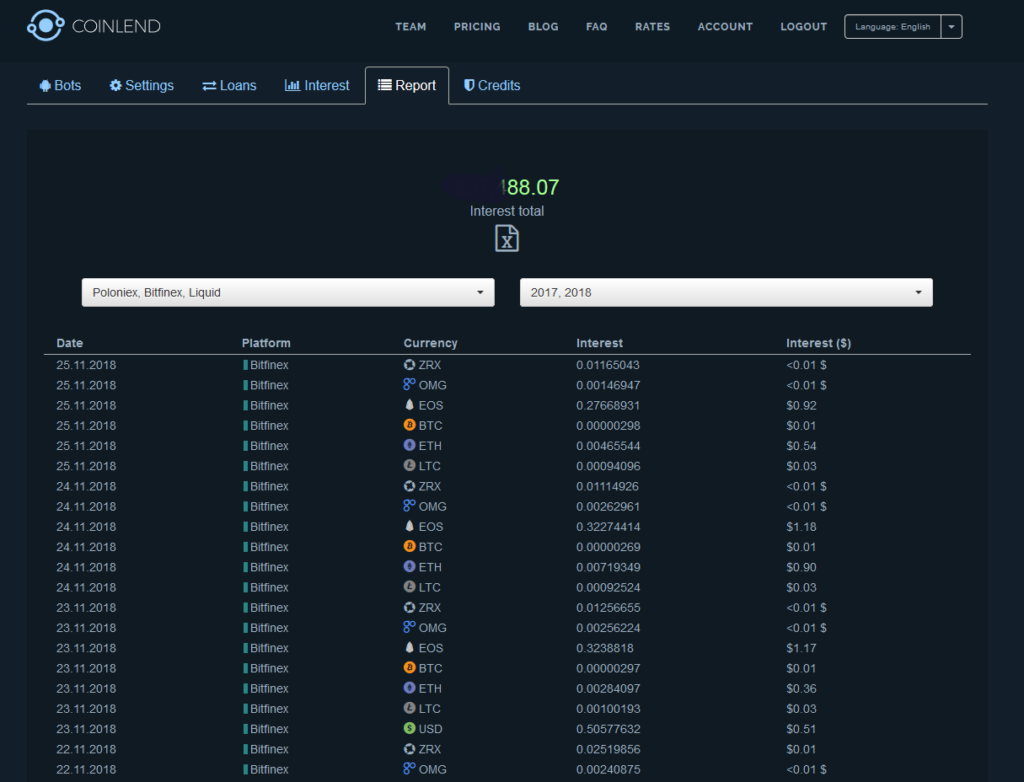

The report tab shows you daily interest from all exchanges. Premium users can download this as an Excel file.

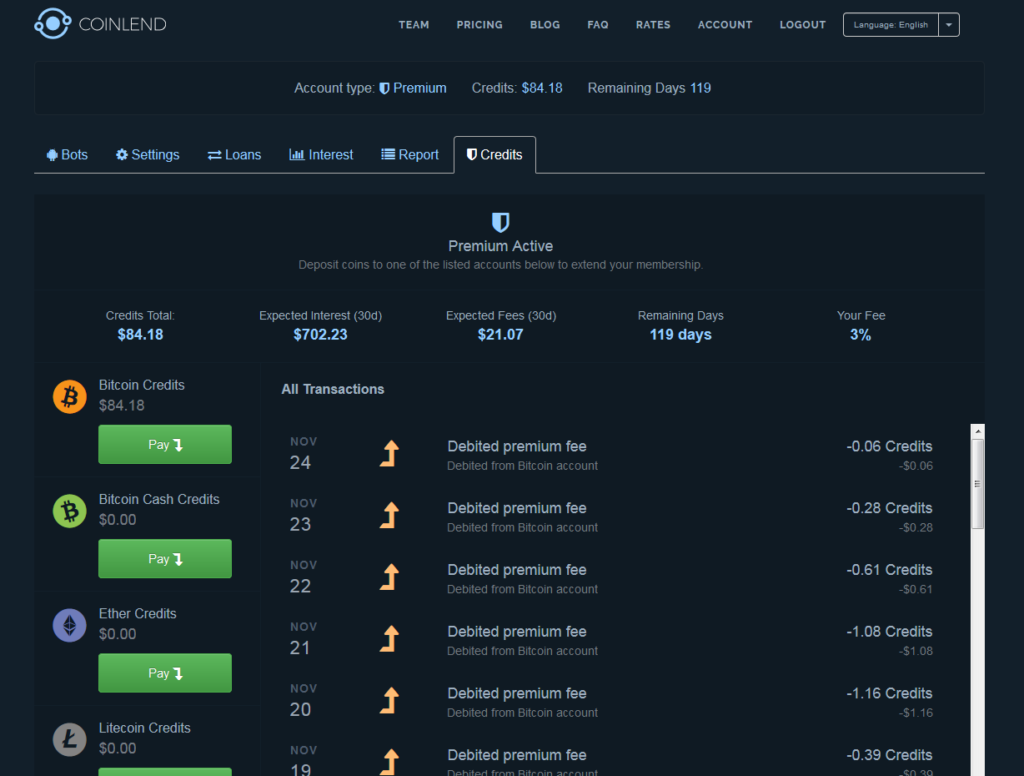

There are three levels of membership once the free 14 day trial has expired. There is Basic, Standard and Premium plans, they all cost 5% of your daily interest as a fee, with a minimum of $1 a week. This is actually a really small amount. All you need to do is top up your account with Credits. You can do this by depositing Bitcoin, Bitcoin Cash, Ethereum, Litecoin and even paying by credit card.

Summary

Lending you funds using Coinlend is a safe and easy way to passively make extra income from any coins sitting in your exchange.Sign up to Coinlend here: https://www.coinlend.org/

Hope you found this step by step guide useful, please feel free to sign up to Coinlend or use any of our referral links found across our website.